Global property prices are rising at the fastest rate since before the financial crisis.

Bloomberg News

June 30, 2021, 9:00 PM EDT Updated on July 1, 2021, 8:05 AM EDT

Around the world, property markets are going bananas.

From the U.S. to the U.K. to China, housing is riding an extended boom. Global valuations are soaring at the fastest pace since 2006, according to Knight Frank, with annual price increases in double digits. Frothy markets are flashing the kind of bubble warnings that haven’t been seen since the run up to the financial crisis, a Bloomberg Economics analysis shows.

On the ground, outrageous stories are rife, with desperate buyers promising to name their first-born after sellers and derelict buildings selling for mansion prices.

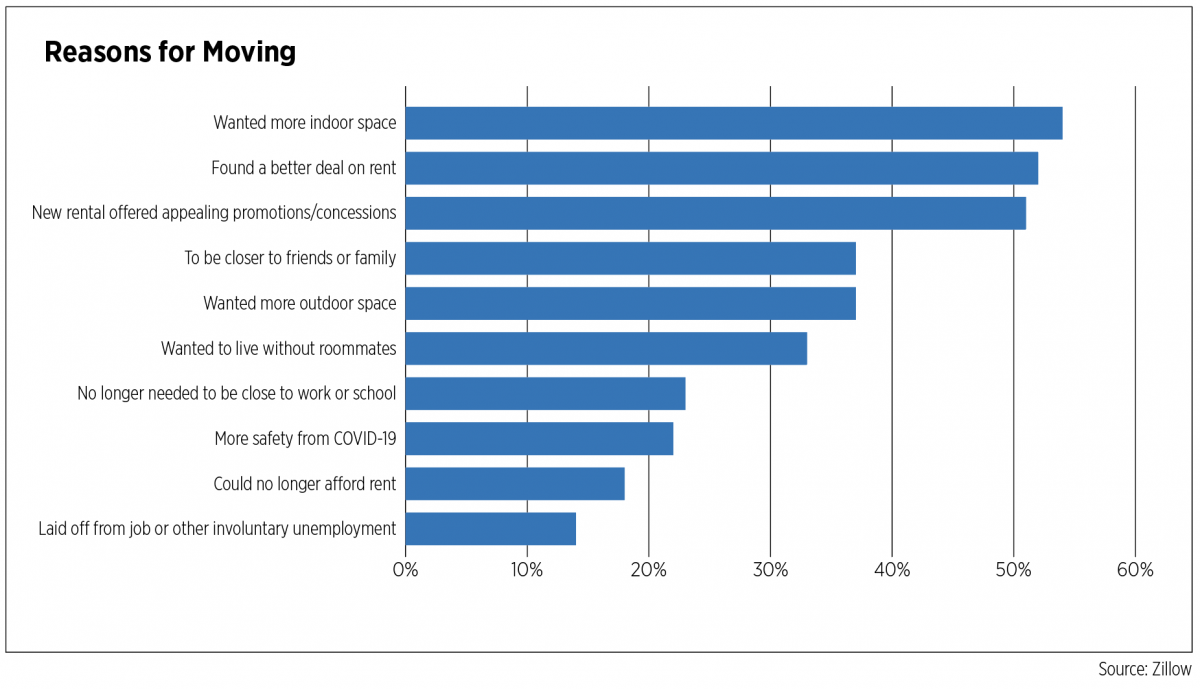

The drivers for the frenzy are remarkably consistent: cheap mortgages, a post-pandemic desire for more space, newly remote workers taking city cash to regional locations — and, crucially, a pervasive fear that if you don’t buy now you may never be able to.

As prices mount, so do the risks for both individuals and society. Even without an outright crash, big mortgages mean borrowers are vulnerable if interest rates rise, have less disposable income to spend in the wider economy and are more likely to retire in debt. For younger people, buying property becomes increasingly difficult, further widening intergenerational inequality.

While regulators are starting to get nervous, there are few signs of meaningful action in most countries. They expect the market will start to cool on its own, arguing that a decade-long focus on higher lending standards combined with the prospect of low interest rates for an extended period means there is no obvious trigger for a crash. Much of the activity is also being driven by owner-occupiers rather than investors, who typically don’t all head for the door at once if prices start to drop.

So for now, expect the wild stories to keep coming. Here are a few of the most startling ones we’ve come across.

Canada

As a real estate agent, Kristin Cripps knew the market was hot in Barrie. Prices in the fast-growing city about an hour and a half’s drive north of Toronto have been pushed skyward as buyers hunt for larger homes or vacation properties on scenic Lake Simcoe.

Yet nothing prepared her for selling her one-bedroom vacation home. It’s not a remarkable property—Cripps says it looks like “a small box” from the outside—but within 24 hours of listing, 192 showings had been booked. And that was only the start.

Throughout the following three days, bidders and agents kept showing up without an appointment, tramping through the snow to bang on the door while Cripps conducted virtual viewings inside.

The property’s narrow driveway became so congested, no fewer than six cars ended up in a ditch and needed to be towed out. At the height of the bidding war, Cripps estimates she was getting about 75 emails every 20 minutes, and didn’t sleep more than two or three hours a night as she tried to keep up with all the inquiries. In the end she received 71 offers. The property, listed for C$399,000 ($328,665), sold for almost twice that sum — C$777,777.

“You know when you see videos of Black Friday and everyone rushes in and they’re grabbing stuff and they’re having fights in the store and pulling people’s hair and there’s security and they’re grabbing people? That’s what it felt like,” Cripps said.

“Everyone was just so hot and bothered to get a property.”

Australia

It didn’t have a kitchen or a toilet or power, let alone flooring or paint. Yet the semi-derelict home about seven kilometers (4.4 miles) south of Sydney’s city center sold anyway—for A$4.7 million ($3.5 million), after a heated bidding war.

It’s just one more jaw-dropping sale in the harborside city, where more than half the houses sold this year fetched at least A$1 million and quarterly gains to May were the highest in more than 30 years. House prices rose by A$1,263 a day in May, while Australia’s housing market just wrapped up its best fiscal year since 2004, figures showed Thursday.

“I’ve been involved in this industry 25 years and seen nothing like it,” selling agent Joe Recep of NG Farah Real Estate said. “We had 30,000 enquiries on the property in four weeks—from UAE [United Arab Emirates], Dubai, America, New Zealand and all the Asian countries."

It’s the top end of the market that’s really motoring. Cashed-up buyers returning from overseas and wealthy locals kept in the country by Australia’s closed borders are prepared to pay eye-watering amounts for a desirable lifestyle.

Sydney's Top-Tier Home Prices Soar

Values rise fastest for the most expensive properties

Sources: Corelogic Inc., Bloomberg

D’Leanne Lewis, a principal at real estate agency Laing+Simmons in the tony eastern suburb of Double Bay, sold homes worth a record A$60 million in a single day in May—more than she had ever previously sold in a month.

Among the five houses Lewis sold on her banner day was an eight-bedroom, nine-bathroom property in Bellevue Hill, an expensive area in the city’s east. It was snapped up pre-auction for $25 million—almost 40% above its advertised price—and more than triple the $7 million it sold for just five years ago. While palatial, it doesn’t have the waterfront views or access you’d normally expect in Sydney at that price.

“It’s crazy but does make sense when you think about it,” says Lewis. “Being locked down in a place like Sydney does not feel so dismal when you compare it to the rest of the world. People are looking for a safe haven.”

U.S.

In the wealthy enclave of Greenwich, Connecticut, you can’t even bank on being able to see a property before you put in an offer.

Shut out of appointments to view a just-listed $1.55 million house, one set of homebuyers decided to make a cash offer above asking price anyway. Their only condition was to be allowed into the house once before signing the contract.

“It was accepted as the highest and best bid, and they’d never been in the house,” said Mark Pruner, a broker with Berkshire Hathaway HomeServices in Greenwich. “There were all these other people lined up for appointments in 15-minute intervals for two days.”

New York's Divided Property Market

Prices in Manhattan keep falling as bidding wars erupt in the outer boroughs.

Source: StreetEasy, Bloomberg, Q1 2021 data, YOY % change

U.S. home prices jumped the most in 30 years in April, with even more dramatic increases in many suburban and rural areas. At the peak of the pandemic, Greenwich attracted exiles from New York City — and they’ve kept coming ever since. Signed contracts for single-family homes more than tripled in May from a year earlier to 165, according to appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. And that’s after a first quarter when the median price of home sales surged 31% to $2.24 million.

In Manhattan, sales have picked up in recent months too, but that’s largely thanks to the prospect of discounted prices. By contrast, buyers pushing deep into the outer boroughs in search of more spacious homes are facing bidding wars.

Things are even hotter in more remote areas of the U.S. Take Boise, Idaho, a picturesque city of roughly 225,000 set against the foothills of the Rocky Mountains. An influx of buyers from California and other more expensive states has sent the market wild: Prices at the start of June were up 42% from a year earlier, according to brokerage Redfin. In April, eight in 10 offers made by its customers faced bidding wars.

Building a Home in the U.S. Has Never Been More Expensive

An influx of buyers has sent the Boise market wild.

Photographer: Jeremy Erickson/Bloomberg

Desperate buyers are doing whatever they can to secure a deal — including promising not to actually move in. Shauna Pendleton, a local Redfin broker, said one vendor negotiated the right to stay in the property for five months on a peppercorn rent until their new home was built.

“Sellers know they’ve got power in this market, they know they hold the cards and that they pretty much make the rules,” Pendleton said.

U.K.

Buying a U.K. property right now is nerve-jangling. Almost a quarter of homes sell within a week, according to estate agents Hamptons International, many before they even hit the property portals.

The intense competition is leaving would-be-buyers like Alyson Nash, 63, and her husband out in the cold. They sold their family farmhouse last year and moved into rented accommodation so they could hunt commitment-free for a property near Guildford, a commuter hub in England’s southeast.

Eight months later, after making offers for three homes at their asking prices of at least 2.5 million pounds ($3.5 million), they’re no closer.

“I had never in my life anticipated it being this difficult,'' Nash said. “There’s very little on the market and what there is, is being chased down by too many people.”

U.K. House Prices Are Rising Faster Outside London

The capital city isn't attracting buyers the way it once did

Source: Acadata

The booming market has led to the resurgence of a practice known as gazumping. Property deals in the U.K. aren’t legally binding until contracts are formally exchanged, which can take months after an offer has been accepted—particularly when mortgage lenders and lawyers are struggling with high volumes.

At any point in this period sellers can accept a different offer. That’s what happened to Charlotte Howard, 46, in February. Four months later, as glacial proceedings on another property left her terrified of being gazumped again, she found herself contacting the seller on Facebook to reassure them of her interest.

“I’m feeling just a bit broken and a bit bruised,” Howard said. “Things can go wrong still.”

Fortunately for Howard, she and the seller exchanged on June 11th.

China

Reining in property speculation is a key objective of the Chinese government. But even they are struggling. While in much of the world the pandemic spurred a dash to the suburbs and beyond, buyers in China piled into top-tier cities where the best jobs and schools can still be found.

Existing home prices in those cities rose 10.8% in the year to May, despite crackdowns on loopholes such as fake divorces, designed to bypass rules on how many properties a family can own.

In the tech hub of Shenzhen, an apartment costs 43.5 times a resident’s average salary, according to the research institute of real estate firm E-House (China) Enterprise Holdings Ltd. That’s not far behind Hong Kong, the world’s least affordable city. With Shenzhen prices rising faster than anywhere else in China, the list of obstacles facing would-be buyers just keeps getting longer—and more arbitrary.

China's Home Price Gains Slow, But Don't Stop

Increases continue despite tough cooling measures

Source: China's National Bureau of Statistics

Note: Existing home sales, year-on-year price change

At one new development in the city’s west, interested parties had to temporarily transfer 1 million yuan ($157,000) and upload personal credit reports before they could even make a bid.

Many of those who managed to do so—not easy, with queues of bidders snaking around the block at bank closing time—still didn’t even get their offers considered.

Under pressure from the local housing regulator to prioritize residents, local developer Coaster Group decided to vet applicants on how long they’d paid taxes in the city. The 2,114 successful applications all had more than 23 years of tax records.

That meant renewed disappointment for many, including Jerry Huang, 29, who has 14 years of Shenzhen tax history. It’s the third time that non-monetary requirements have prevented him from even making a bid.

“It looks like I have to shelve the purchase plan for a long time,” Huang said. “There are so many people competing I’m not sure I have a winning chance.”

— With assistance by Emily Cadman, Ari Altstedter, Olivia Konotey-Ahulu, Charlie Wells, Emma Dong, Nabila Ahmed, Prashant Gopal, and Oshrat Carmiel

(Updates with Australia housing market figures in 14th paragraph.)